Condo Insurance in and around Chicago

Condo unitowners of Chicago, State Farm has you covered.

State Farm can help you with condo insurance

- Norridge

- Harwood Heights

- Dunning

- Belmont Cragin

- Cook County

Your Search For Condo Insurance Ends With State Farm

When looking for the right condo, it's understandable to be focused on details like home layout and location, but it's also important to make sure that your condo is properly covered. That's where State Farm's Condo Unitowners Insurance comes in.

Condo unitowners of Chicago, State Farm has you covered.

State Farm can help you with condo insurance

Condo Unitowners Insurance You Can Count On

With this coverage from State Farm, you don't have to be afraid of the unexpected happening to your biggest asset. Agent Jennette Torres can help lay out all the various options for you to consider, and will assist you in building an excellent policy that's right for you.

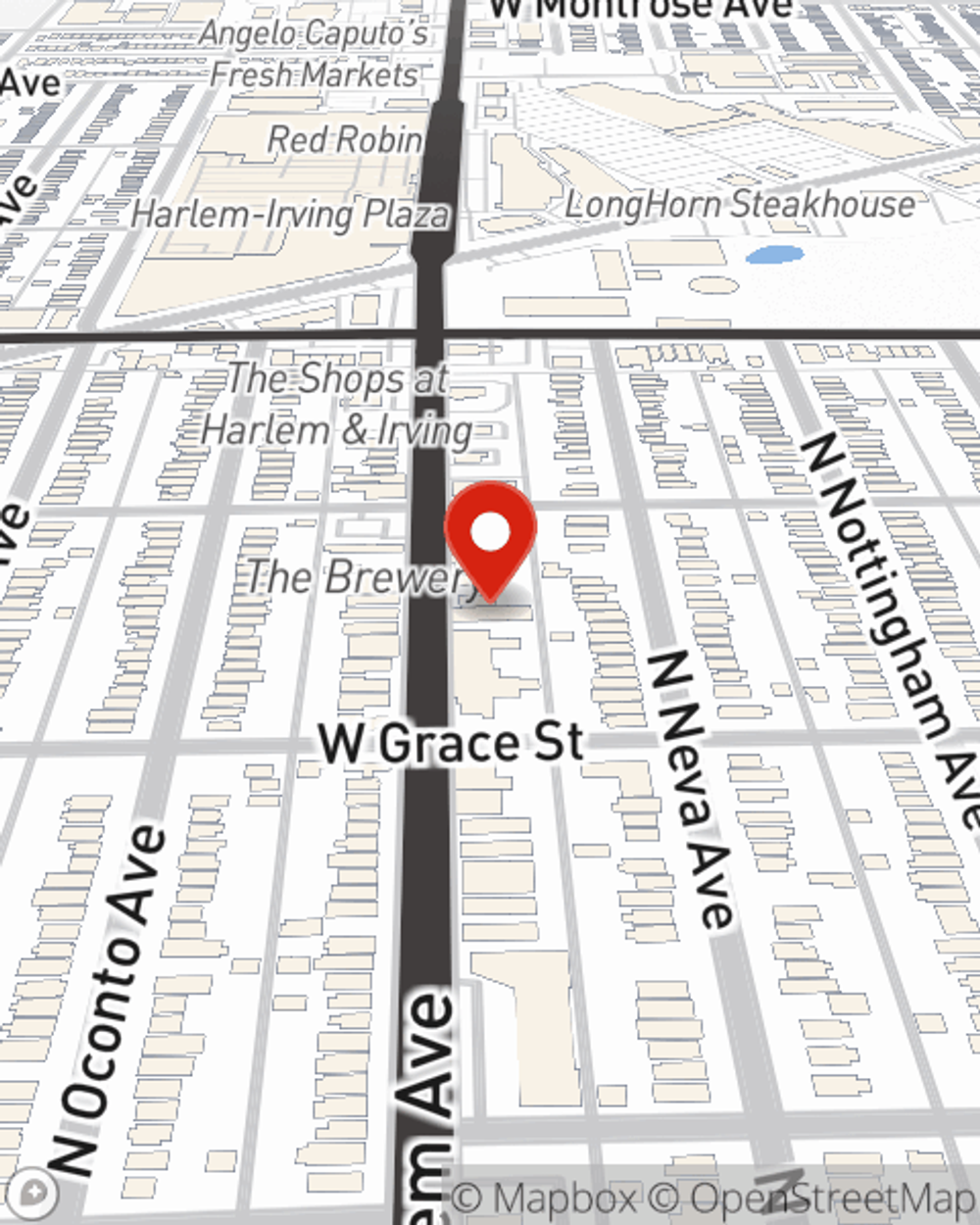

Getting started on an insurance policy for your condo is just a quote away. Visit State Farm agent Jennette Torres's office to explore your options.

Have More Questions About Condo Unitowners Insurance?

Call Jennette at (773) 930-3202 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Jennette Torres

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.